Payroll Audit Guidelines & Complete Guide

Audit your data safety practices, encryption insurance policies, and backup systems to stop unauthorized modifications or breaches in the course of the audit course of. Preparation is the muse of a easy and effective payroll audit. With Out correct planning, audits can turn out to be time-consuming, chaotic, and incomplete. Under is a detailed step-by-step breakdown of tips on how to put together efficiently for a payroll audit.

Consciousness Of Wage And Tax Charges

- In brief, regular payroll audits are not just about compliance, they are about creating a culture of precision and accountability.

- Because HR communicates pay to employees, and there can be errors between what HR or a supervisor tells an worker and what leads to the payroll system.

- Catching issues early can help you keep away from bigger complications down the road.

- Payroll compliance software program helps companies observe financial and labor regulations when paying employees.

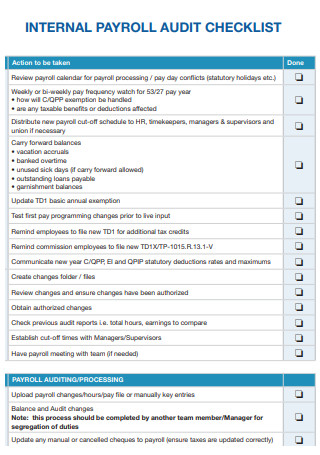

Focus on making certain that all time entries embrace correct supervisor approval and that break periods comply with state-specific requirements. Many organizations overlook the requirement to pay for brief breaks beneath 20 minutes, while meal durations over 30 minutes can stay unpaid if employees are fully relieved of duties. Fashionable payroll methods generate huge amounts of data that require human oversight to catch errors that automated systems miss. Regular audits ensure these systems function correctly and identify areas where further coaching or process enhancements are needed. Use our downloadable payroll audit guidelines to remain on observe, guarantee your payroll audit procedures are effective, and remain compliant. The staff is devoted to watch and interpret complicated legislative changes in each nation the place we function.

Common implementation of those audit procedures creates a culture of accuracy and compliance that advantages everybody in your group. Begin with quarterly audits and steadily increase frequency as your staff turns into more comfortable with the method and identifies areas that require further consideration. Start by verifying that every one worker files contain present I-9 forms and supporting documentation inside the required timeframes. The Immigration and Customs Enforcement company conducts regular audits, and missing varieties lead to fines starting from $230 to $2,300 per employee.

Also, companies ought to plan particular areas in payroll processes that might be examined. Operational effectivity can be improved by having a payroll audit process no less than annually. It identifies errors and helps organizations confirm that accurate payroll calculations are made. The audit process can establish areas of inefficiency and allows for taking actions to resolve these issues. Some of the options are simplified workflows and quick processing instances. The insights generated from audits reveal numerous tendencies that facilitate data-driven decision-making.

The size of time to complete a payroll audit could also be as quick as a few minutes or as long as a quantity of weeks. Finally quickbooks compliance, the variety of workers and the quantity of information being analyzed will determine the period. A key element of any payroll process is the ongoing evaluation by senior administration to ensure the staff is meeting efficiency targets and compliance standards. It provides an in depth record of steps you could undertake to process payroll for substitutes.

– Evaluate integration between attendance system and payroll software. When internal payroll information are well-audited, exterior audits or authorities inspections become seamless, saving time and reducing stress. By identifying non-compliance early, organizations can avoid heavy penalties, preserve their popularity, and ensure authorized peace of thoughts.

Payroll Audit Checklist Template: Core Areas To Review

Use this easy-to-follow payroll checklist to avoid https://www.quickbooks-payroll.org/ common mistakes, stay compliant, and keep your group joyful. When businesses fail to take payroll audits critically or ignore key compliance obligations, the fallout could be significant. Payroll audits may be made simpler with varied insights out there through real-time dashboards and analytics. It helps identify and take corrective actions to improve the audit process. When organizations have access to insights, they can make data-driven decisions and improve operational efficiency.

Paycor is the trusted compliance associate for greater than 30,000 organizations nationwide. Our payroll processing and tax filing software reduces errors and helps mitigate threat with federal and state laws. From correct HR, payroll, and time solutions to skilled support, Paycor helps you see around corners, so you don’t fall sufferer to compliance regulations or authorities audits. A payroll audit is an in depth evaluate of a company’s payroll information to ensure employee payments, tax deductions, and compliance processes are accurate and legally right.

Guarantee people who find themselves on leaves of absence obtain the proper pay as nicely, particularly if this differs from their common paycheck. If the info entry process is guide, then automated validation tools can come handy for conducting regular checks. Collecting comprehensive documents and a set of data is important for payroll audits. Affirm that every one payroll inputs, corresponding to timesheets, bonus calculations, and expense claims, are precisely recorded. For payroll companies outsourcing, be certain that timesheets are permitted by approved personnel to keep away from discrepancies.

It helps make sure that all needed duties are completed in an organised manner. By allocating timeline, corporations can maintain the audit on monitor without any delay. Post-payroll duties, similar to payslip distribution, reconciliation of compliance stories, and submission of the General Ledger (GL), should be tracked fastidiously. For payroll companies providers managing these activities, be positive that these reports are precisely submitted to the finance and compliance departments. For example, this might embrace a delayed payroll course of, a $200 overpayment, or the necessity for a revision because of incorrect tax calculations. Collect and replace all employee-related info, similar to tax ID numbers, cost preferences (direct deposit or check), and payroll classifications (full-time, part-time, or contractors).